Cca depreciation calculator

At depre123 try out our Free Depreciation Calculator and check out our cloud based fixed assets application. Can you claim CCA.

Calculating The Capital Cost Allowance Cca Youtube

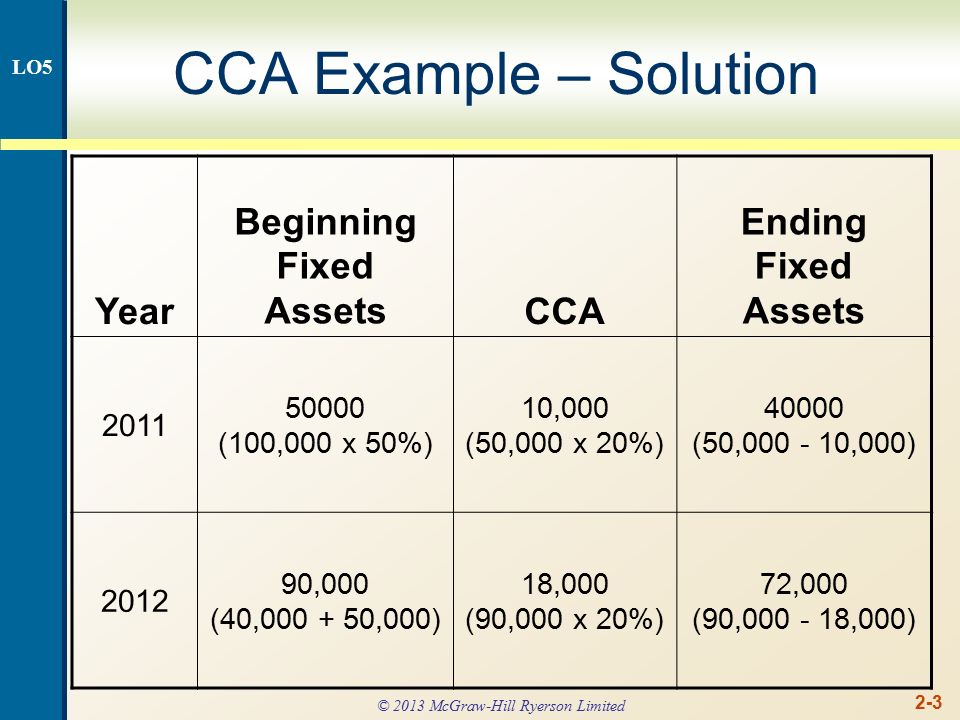

To do this he has to use the following formula.

. All you need to do is. Class 6 10 Include a building in Class 6 with a CCA rate of 10 if it is made of frame log stucco on frame galvanized iron or corrugated metal. Capital cost allowance wikipedia.

Basic information about capital cost allowance CCA Current or capital expenses declining-balance method fiscal period less than 365 days. Cash flow after deprecition and tax 2. Capital cost allowance depreciation definition.

For example lets calculate the CCA on a business vehicle in its first three years of use. Building value 75000 total purchase price 90000 total expenses 5000 part of the expenses that can be added to the cost of. We will even custom tailor the results based upon just a few.

Classes of depreciable property. The vehicle was purchased for 30000. Table of Capital Depreciation Rates.

To help calculate your current tax year deduction for CCA and any recaptured CCA as well as terminal losses use. Periodic straight line depreciation Asset cost - Salvage value Useful life. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

In addition one of the. This also requires an adjustment for. Form T2125 Statement of Business or Professional Activities Area A.

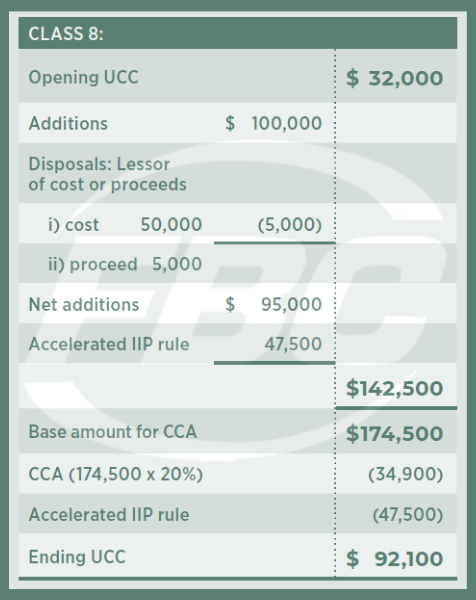

Select the currency from the drop-down list optional Enter the. It is fairly simple to use. Capital Cost Allowance Permitted Depreciation Undepreciated Capital Cost Depreciation Rate.

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. You might acquire a depreciable property such as a building furniture or equipment to use in your rental activity. The calculator also estimates the first year and the total vehicle depreciation.

Also includes a specialized real estate property calculator. Line 22900 was line 229 before tax year 2019. Information relating to capital cost allowance.

In current cost accounting CCA assets are shown in the balance sheet at the current replacement costs after allowing for depreciation. How to calculate CCA. Posted in Answers Depreciation Methods.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. What is the difference between straight-line depreciation and. It belongs in CCA class 10 giving it a CCA.

Capital cost allowance CCA for rental property.

2

Tax Shield Formula Step By Step Calculation With Examples

Capital Cost Allowance For Farmers Fbc

Solved 2 A Given The Following Income Statement Calculate Chegg Com

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Cca Calculation Youtube

Capital Cost Allowance Canada Youtube

Capital Cost Allowance Cca For Canadian Assets Depreciation Guru

Tax Shield Formula Step By Step Calculation With Examples

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

What Is The Purpose Of Cca How Is It Calculated Why Are Items Typically Pooled Into The Same Cca Class Intermediate Canadian Tax

Depreciation The Cca Inflation Chapter 7 12 Outline Depreciation Defined Types Of Depreciation Before And After Tax Marr Ucc And The 1 2 Yr Rule Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

Cca Calculation Youtube

Some Cca Classes Table Ppt Video Online Download